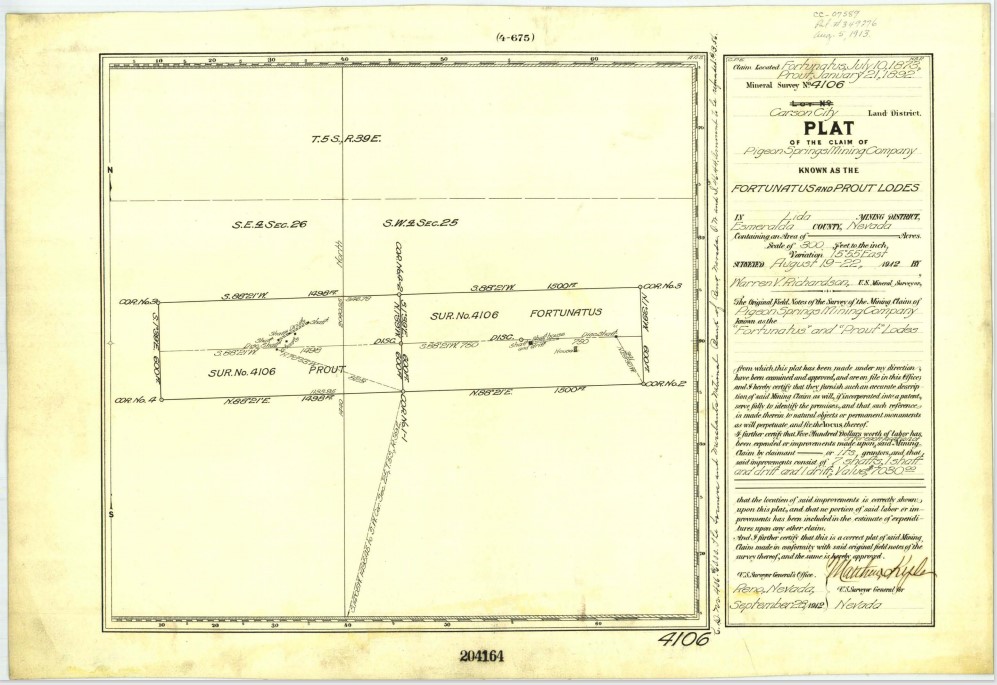

VACAVILLE, CA – June 9, 2022 – Athena Gold Corporation (OTCQB: AHNR)(CSE: ATHA) (“Athena” or the “Company”) reports that it has entered into an acquisition agreement (the “Acquisition Agreement”) with an arm’s length private party (the “Vendor”) to purchase an undivided 100% interest (the “Transaction”) in the Fortunatus and Prout patented lode mining claims (Mineral Survey 4106) in Esmeralda County, Nevada (the “Claims”) for USD $185,000 (the “Purchase Price”). The Transaction is scheduled to close on or before July 1, 2022 (the “Closing”).

Claims

The Claims are currently held by the Company under a lease option agreement that expires in June 2023 and are an integral part of the Company’s flagship Excelsior Springs project including the high-grade gold historic Buster Mine. The Fortunatus lode claim was originally located on July 10, 1873 and the Prout lode claim was located on January 21, 1892.

Commercial Terms

The commercial terms of the Transaction are:

- The Purchase Price of USD $185,000 will be settled as follows:

- ooUSD $25,000 will be settled in cash paid by the Company to the Vendor at Closing;

- ooUSD $35,000 of the Purchase Price will be settled by the issuance and delivery to the Vendor at Closing of 500,000 shares of the Company’s common stock (the “Consideration Shares“), each issued at a price of $0.07 per Consideration Share (being the 20 day volume weighted average price on the over the counter market, calculated as of the day the Acquisition Agreement was fully executed). The Consideration Shares are to be deposited into escrow for delivery to the Vendor upon the recording of the deed of transfer for the Claims. The Consideration Shares will be subject to applicable United States resale restrictions; and

- ooUSD $125,000 will be settled by a loan to the Company by the Vendor (the “Loan“) at Closing, repayable by the Company in quarterly installments of USD $25,000, beginning 120 days after Closing, and continuing on the same day of each and every consecutive calendar quarter thereafter until 15 months after the Closing, at which time the entire remaining unpaid principal balance will be payable. The Loan will be evidenced by way of a secured first purchase money note issued by the Company to the Vendor.

- The Vendor will relinquish the 2% net smelter returns royalty on the Patented Claims in favor of Athena upon full payment of the Purchase Price.

John Power, Athena’s President & CEO commented, “We are pleased to have agreed to acquire these patented claims from a private party who has been supportive of our exploration efforts at the Excelsior Springs project. These are the only patented claims in our project area and are the heart of the Excelsior Springs project. Our lease option on these claims was set to expire in June 2023 and this early purchase was beneficial to both parties.”

About Athena Gold Corporation

Athena is engaged in the business of mineral exploration and the acquisition of mineral property assets. Its objective is to locate and develop economic precious and base metal properties of merit and to conduct its exploration program on the Excelsior Springs Project, located in Esmeralda County, Nevada, approximately 45 miles southwest of Goldfield, Nevada.

For further information about Athena Gold Corporation and our Excelsior Springs Gold project, please visit www.athenagoldcorp.com.

On Behalf of the Board of Directors

John Power

Chief Executive Officer and President

Contact:

Phone: John Power, 707-291-6198

Email: info@athenagoldcorp.com

Forward Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian and U.S. securities laws. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the payment of the Purchase Price and the Loan, the completion of the Transaction, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: “believes”, “will”, “expects”, “anticipates”, “intends”, “estimates”, “plans”, “may”, “should”, “potential”, “scheduled”, or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this press release, the Company has applied several material assumptions, including without limitation, that there will be investor interest in future financings, market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future exploration and development of the Company’s projects in a timely manner, the availability of financing on suitable terms for the exploration and development of the Company’s projects and the Company’s ability to comply with environmental, health and safety laws.

The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, operating and technical difficulties in connection with mineral exploration and development activities, actual results of exploration activities, the estimation or realization of mineral reserves and mineral resources, the inability of the Company to obtain the necessary financing required to conduct its business and affairs, as currently contemplated, the timing and amount of estimated future production, the costs of production, capital expenditures, the costs and timing of the development of new deposits, requirements for additional capital, future prices of precious metals, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, lack of investor interest in future financings, accidents, labor disputes and other risks of the mining industry, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, risks relating to epidemics or pandemics such as COVID-19, including the impact of COVID-19 on the Company’s business, financial condition and results of operations, changes in laws, regulations and policies affecting mining operations, title disputes, the inability of the Company to obtain any necessary permits, consents, approvals or authorizations, including of the Canadian Securities Exchange, the timing and possible outcome of any pending litigation, environmental issues and liabilities, and other factors and risks that are discussed in the Company’s periodic filings with the SEC and disclosed in the final long form prospectus of the Company dated August 31, 2021.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this press release or incorporated by reference herein, except as otherwise required by law.

Copyright (c) 2022 TheNewswire – All rights reserved.